Solutions to Sensitive Tax Problems

Refund Claims

Once taxes have been assessed and paid, the IRS will not voluntarily provide you a refund if there is an overpayment. You must file a refund claim pursuant to IRC Section 6511(b)(1). If you overpaid income taxes, you may claim a refund on Form 1040 (or Form 1120) for the current tax year or on Form 1040X (or Form 1120X) for the previous tax years. For refunds of other taxes, you must file a Form 843, Claim for Refund and Request for Abatement.

Form 843, Claim for Refund and Request for Abatement

While Form 843 seems simple as it is only one page long, taxpayers must be aware that the claim must be detailed enough that the IRS can understand the exact basis of the claim for refund. A claim that does not provide sufficient facts will not be considered. This is extremely important because the IRS will not let you amend your claim after the statute of limitations for the claim has expired. If you failed to provide enough facts, you may still be able to argue that the IRS knew or had reason to know the underlying basis of the claim.

Statute of Limitations

A claim for a refund must be filed on or before the later of:

- Three years from the date the tax return was filed; or

- Two years from the date the tax was paid.

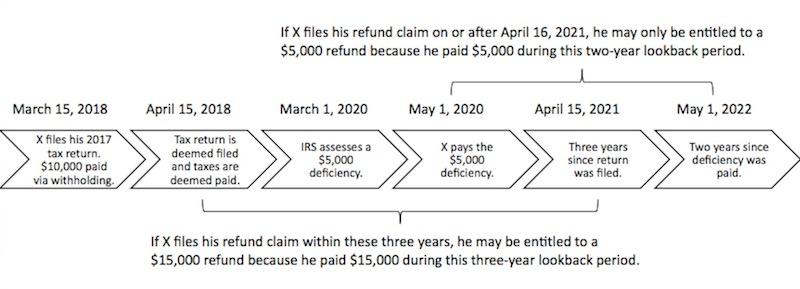

You should file a refund claim as soon as possible because timing affects the amount of the potential refund to the “lookback period.” 6511(b)(2) limits the maximum potential refund to the amount paid between the date the tax return was filed and three years after the filing date, or the amount paid between the date the tax was paid and two years after the payment date. Furthermore, under Section 6513(a), if a return is filed or payment is made before the due date, then the return is deemed filed and payment is deemed made on the due date for purposes of the statute of limitations. Please see the example below.

March 15, 2018

- X files his 2017 tax return. He owed $10,000 for tax year 2017, which was paid via withholding. Because he filed and paid before April 15, 2018, his tax return is deemed filed and taxes are deemed paid on April 15, 2018.

March 1, 2020

- The IRS assesses a $5,000 tax deficiency against X.

May 1, 2020

- X pays the $5,000 deficiency.

If X files a refund claim by April 15, 2021, X may receive a refund from the $15,000 total he paid, because, within the three-year lookback period, he paid $15,000. If, however, X files a refund claim between April 16, 2021 and May 1, 2022, he will be limited to the $5,000 he paid on May 1, 2020, because he paid only $5,000 during the two-year lookback period.

If you have filed for an extension, then the lookback period is also extended by 6 months. If, however, you file before extended due date, you must file a refund claim within three years from the date you filed your tax return.

If you signed an agreement to extend the statute with the IRS, e.g. Form 872, you may file a refund claim any time within six months after the agreed date. You may also claim a refund on the entire amount. For the example above, if X had agreed to extend the time to assess taxes until April 15, 2022, X will have until October 15, 2022 to file a claim for refund on the entire $15,000.

Refund Suits

If the IRS denies your refund claim or does not grant your refund claim within six months of its filing, you may file a refund suit in the United States district court or the Court of Federal Claims. A refund suit must be filed within two years from the date the IRS rejects the refund claim or two years from the filing date of Form 2297, Waiver of Statutory Notification of Claim Disallowance, which waives the requirement that you be sent a notice of disallowance of the refund claim.

The biggest difference between the Federal Court of Claims and the United States district court is that a jury will not deliberate on your refund suit in the Federal Court of Claims. Furthermore, Federal Court of Claims judges tend to have more experience in tax issues than United States district court judges. The Ben-Cohen law firm tax attorneys can go over choice of forum issues with you in further detail.

Dealing with refund claims is complicated and involves navigating intricate rules. If you believe the IRS owes you a refund, contact the tax attorneys at the Ben-Cohen Law Firm. Pedram Ben-Cohen is an attorney, a CPA, and a Board Certified Taxation Law Specialist who can help you at every step to ensure the best possible outcome. Contact us at (310) 272-7600 or complete our online form to set up an appointment.